It takes grit to pay off student loans and not lose hope. Here are 11 tips to keep the faith, make it a little more fun, and overall increase your confidence so you can pay off student loans with grace.

This post contains affiliate links, please see my disclaimer for more information.

11 TIPS TO SUCCESSFULLY PAY OFF STUDENT LOANS

BE CREATIVE WHILE YOU PAY OFF STUDENT LOANS

Get paid for a hobby you like or need

I get paid for helping others have a community in an online fitness group, which pays for my health and fitness expenses so they then don’t have to come out of my pocket (my unlimited online gym membership, equipment, supplements, etc). It doubles as an accountability group to myself and since starting five years ago, I have been able to stay consistent in 4-5 workouts a week; something that before running this group was a huge struggle for me.

Creating additional streams of income isn’t just great for paying off student loans, it also increases your money mindset to one of scarcity to one of abundance and like having a diversified stock portfolio, it’s also ideal to have multiple ways to make money.

Maybe your hobby is different and more crafty and etsy is a place where you can earn extra money like those cute macrame plant holders all my friends on insta are making. You can also use Teachers Pay Teachers or Etsy to sell digital products (pdfs, graphics, etc) that you can make for free on Pic Monkey or Canva.

You can also consider starting a blog and creating content as a money making passion project by using affiliate links in your posts, selling direct digital downloads, or increasing your traffic to get paid with ads. A youtube channel is another way to use affiliate links and (if you qualify) ads to create additional streams of income.

You can also self-publish books on Amazon, which I love, because it’s low cost and Amazon is a great search engine so if there is a need in the marketplace, your book might just sell itself (like our Pediatric Exercise Handbook which sells 50-80 copies a month without advertising).

There are a million ways to get paid online, but they’re not always a sure thing. What I would highly recommend is to view this as a long game with your first goal to be about breaking even and creating products that can build over time. Ideally, whatever you pick, is something you would’ve done anyway, but now you’re deciding to monetize it.

Have dinner at home and go out for drinks

Batman (my husband) and I often cook dinner at home and meet our friends out for drinks or go out for drinks by ourselves. It ends up being healthier that we cook at home and saves us at least $50/date night.

This works because we put more of an emphasis on trying new beers than we do on foodie style dinners. This switch up might look different for you but brainstorm and you might come up with something clever like only using groupons for dates.

Another option is to grab a home delivery meal kits like Hello Fresh or Blue Apron and use the money you would alternatively spend eating out on making a meal together at home. This way you can have dinner and drinks for significantly less per meal, while learning a worthwhile skill (cooking) in the process.

Figure out what you CAN sacrifice without it feeling like a sacrifice

I don’t spend much money on clothes. I wear the same seven grey v-necks practically every day and own seven pairs of pants. I am not Martha Stewart so our house decor is what Batman likes to call “bachelor interrupted.” In fact, our favorite couch of all time was picked up on the side of the road by Batman and his USMC buddies over 12 years ago (so glad he was the last to leave and we inherited it!).

I’m okay with not going out to eat a lot if I am allowed to make (and eat) guacamole every single weekend with pretzel thins (definitely recommend it if you haven’t tried it yet!). I like to have a travel fund, but if money is tight weeknight walks while talking with batman are a must.

Find the things that you don’t really care about and give yourself permission to NOT spend money on them.

Hate decorating? say peace out to all your Martha Stewart friends and embrace minimalism. If you’re a wife, it’s okay to not care about decorating, I promise. Hate shopping? Focus on paring down your wardrobe to the must haves or using a capsule closet.

Find yourself spending a ton on clothes or tech randomly throughout the year that throws your budget totally out of whack? Calculate how much you spend in those categories and then divide it by 12 (months) and put that amount into a separate account so whenever you do a big shopping spree (like all of a sudden half your pants have holes in them) you ALREADY have the money for it.

Use cash back responsibly to increase payments toward your loan

I personally use chase credit cards but you could also use sites like Rakuten (previously Ebates) and others to get cash back without increasing your budget. I used upromise.com back when I first started (similar to Rakuten) and would buy my make-up through their website to get an increased % back.

Any extra money I received from those sites or rewards from my chase credit cards would/still does go to my student loans. This only works if you do not overspend and pay your balance monthly (are not getting charged interest on your cards).

Another reason I really like putting all my expenses on my credit card (while paying it off every month) is that at the end of the year, Chase, will break down my purchases for me into categories. It’s super helpful for my business credit card as well as my personal credit card.

Like I mentioned in the previous paragraph, if you find that you don’t have consistent purchases but you know you spend about the same amount each year, it’s so helpful to break that down monthly and put that money aside ahead of time.

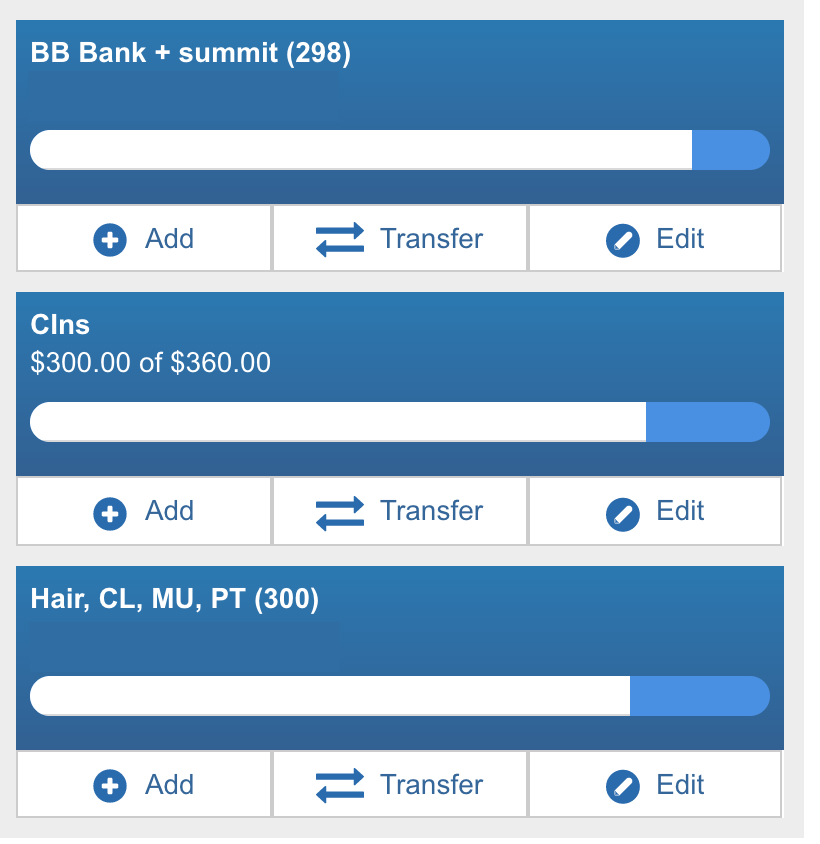

Personally, I break down what I spend on make up, hair, physical therapy expenses (CEUs/licensure) and clothes into one account (225/month) and car insurance into another account (60/mo) so when my car insurance is due twice a year, it’s not a huge 300+ expense all at once that murders my budget.

I am team bulk buy including clothes and make up, so this works well for me. It also helps me with not feeling guilty for spending money on “frivolous things,” because I already put the money away and created a plan for it. I use the PNC bank “virtual wallet,” account along with a regular checking account (for only student loans) and a high yield savings account (for savings).

The virtual wallet account comes with three accounts: regular checking “spend” account, regular savings “growth” account, and an in-between “reserve” account for over draft or mid-term savings goals. The “reserve” account is super helpful because I’m able to transfer money to/from the mini accounts: car insurance, side hustle accounts, and the “other” make up, hair, PT, clothes account.

So if I spend $100 on a haircut that month, it goes straight from my “other” part of the reserve account to my checking account to pay my credit card bill, but that $100 doesn’t get calculated into my budget because the $225 savings is already a part of the budget.

HAVE A RIGHT NOW PLAN AND A MIDTERM PLAN

Look into refinancing as a solution to pay off student loans

Look for a sub-5% FIXED interest rate. Trust me, even if the variable loan rates seem good, they’re so stressful. I would only recommend considering a variable interest rate if you have less than a year to pay off that loan.

I personally had a variable interest rate from 2012-2016 and for a while it was steady, but then it started to increase every MONTH, which was exhausting and stressful. So definitely recommend fixed interest rates so you can plan your life and feel confident in your goals.

Play around with the USAA custom calculator in their app. Pro Tip: you don’t have to be a member, just x out of the login page, and go to “custom loan calculator.”

Experiment with term lengths (10-year, 7-year, 5-year), monthly payments, and interest rates to figure out the best way you can hit your goals. Be sure to double-check on what benefits you may lose if you refinance federal loans (I refinanced all my loans and was okay with losing some benefits for a lower interest rate, but that may not be the case for everyone).

If you’re looking for companies that others have refinanced with, head over to the student loans page for links to the three companies I have refinanced with (sofi x2, laurel road, and citizens bank).

Have a 5-8 year plan to pay off student loans (or a big milestone)

In my opinion, the 5-8 year plan is a sweet spot. 10 years seems too far away and 8 years will honestly fly by faster than you think. We created our own 8 year plan in 2017 and as I write this it’s already the 5 year plan, which is totally mind-blowing because it seemed to go pretty dang fast.

Figure out what your plan looks like to pay down debt, save for retirement, and plan for your future. The key to this plan is it is DOABLE with the financial situation you are in now, it is NOT a herculean effort (this is KEY).

When I was 30 and Batman and I were moving from NC to WA (before we were married) we came up with our 8 year plan. We named it the 8-year plan because that was how long batman had before he retired from the Marine Corps.

My part of the 8-year plan was:

$500/month to retirement or $6,000/year which would get me to 1 million in retirement by 65 (I had some < 25k in retirement at this point)

Student Loans paid off $1657/mo (could change if I refinanced again) by August 2025 (a few months prior to retirement so I can enjoy his 60 days of terminal leave)

Car paid off (this will be paid off early Nov 2022) and then continue to save $304/mo so that I have a car fund for retirement in case anything happens to Jeep Jeep.

Also, be okay with the plan changing if it needs to. Now that we’re in the five year plan, I have refinanced for a fourth time (gosh, I’m wild) to decrease my monthly payments from $1657/mo to $1170/mo (interest rate went from 3.97% to 3.24%).

We refinanced because WA state had a pay scale about 20-30k higher than where we live in Wisconsin (for Physical Therapy) and the 2020 pandemic, resulted in me only finding a part time job. We needed to decrease the monthly payments in order to make it work.

What we decided was that November 2025 was still within the 8 year plan (as opposed to May 2024 end date of my previous payment plan) and would be significantly less stressful with a higher quality of life. The interest difference (due to the lower interest rate) was only a few hundred dollars, so we weren’t concerned about that.

Ideally what will happen, is that we will still shoot to pay my loans off by August 2025, making a few extra payments here and there when the market picks back up and/or my online income increases.

Track your student loan debt spend down using pen and paper (and colored pencils)

Tracking your money is empowering once you get over releasing your fear around your ability to manage it. Using fun color-in trackers can make all the difference.

I’ve used these in the past:

Tracking in general is a game changer for your mindset and helps you stick to your plan. In addition to coloring trackers, I have also used a blank piece of paper to track every single penny I have put to the loans. Doing this, allows me to see that I am capable of saving money regardless of where it is going right now.

If you are able to put $100,000 toward your student loans (which I hit in 2019 after paying my loans since 2014), you will all of a sudden feel SO POWERFUL. Yes, that is a lot of money that is going toward your education, but YOU DID THAT, not anyone else.

If you are capable of saving that money for your loans, how much better is that going to feel when you save it for something more fun like a house?!

BECOME A BETTER PERSON WHILE YOU

PAY OFF STUDENT LOANS

Read personal development books

Reading is one of the best ways to elevate yourself, your habits, and thinking. Money mindset is no different than learning how to cook. You might know how to make a sandwich on your own, but you probably need to take lessons or at least youtube how to cook a fancy meal if someone didn’t take the 1:1 time to help you learn.

Same goes for understanding your own relationship with money. You likely have the same perspective about money as your parents have/had when you were growing up. This happens to all of us, in fact one of the reasons there are such huge disparities in wealth is on how people are taught to interact with money.

A lot of times, wealthy people teach their children how to create money that doesn’t require you to trade your time for dollars such as creating investments that give you dividends via the stock market or investing in businesses, etc.

One of my favorite books is you are a badass at making money because Jen Sincero’s stories are entertaining and her mantras/exercises in the book are really great too. Other books I love include Abundance Now by Lisa Nichols, and the free ebook by Sean Croxton 5 Money Mindset Blocks or his Money Mind Academy course.

Listen to motivational podcasts

Another favorite of mine is The Quote of the Day Show, also by Sean Croxton. It will help you increase your money mindset every Friday and motivate you to kick butt the other days of the week. Best part? It’s 12 minutes a day with new episodes Monday-Friday.

IT’S ABOUT YOUR FUTURE SELF,

NOT JUST YOUR PAST OR CURRENT SELVES

Track your wealth NOT just your debt

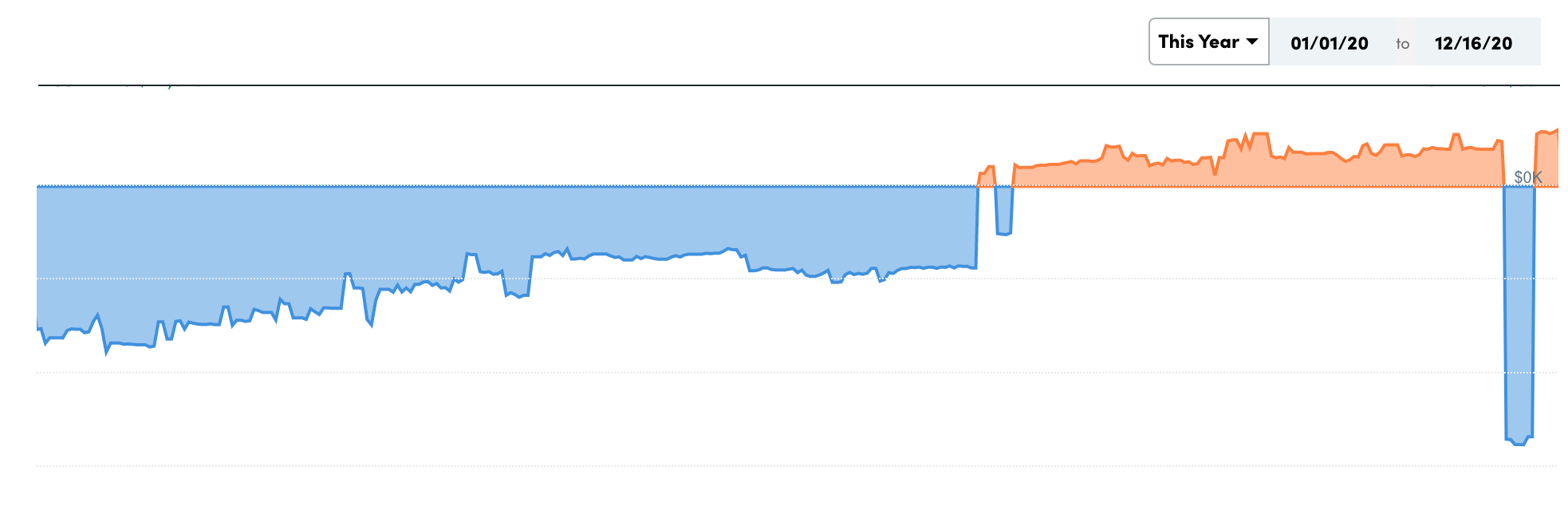

I also super love using personal capital to track your net worth as compared to just tracking your debt. If you haven’t heard of personal capital, make sure to check it out as it’s totally free. Some people do experience them reaching out via phone to pitch their investment services (but I hear you can block the numbers and it stops!).

Download the personal capital app and set it up via the webpage (faster). It tracks your net worth NOT just your debt and it has graphs, which are cool, because they change. Seriously, do it. When you’re not -70,000 in debt anymore, and you’re at 0 net worth, it WILL feel awesome.

I really like it (they don’t call me because I’m still barely at a networth of zero!) because even if you have tons of debt (64k+ in student loans + car loan at 7k) and minimal retirement accounts (saving 6k/year) when you pay down your debt and keep saving for retirement it gives you a big picture view of your progress.

There are tons of graphs and you can change the timeline to a year, lifetime, or 90 days. I am obsessed with watching my networth change and it keeps me motivated to stay on course!

I have my savings accounts, checking accounts, business accounts, credit cards, car loan, retirement accounts all linked. You can also link your mortgage (my husband links our mortgage but I want to keep ours separate until I pay off my student loans, which is why we have separate accounts still).

If you have separate accounts with your significant other, I do highly encourage sharing your journey via the personal capital app while sitting on the couch to make talking about money a totally normalized conversation!

DO NOT SKIP RETIREMENT TO PAY OFF STUDENT LOANS

Do you hear me? Your 65-year-old self did a lot for you, so treat it well. Your body will be tired, so don’t skip retirement saving because you’re too stressed about your loans. Do both.

Do not forsake your future self because your past self borrowed a lot of money. Do both just slower. Also, download the personal capital app, because it makes retirement savings actually feel fun and not stupid.

Let’s be honest here, it’s going to take you some time to successfully pay off student loans. It isn’t an overnight thing, and sometimes I worry about people who sacrifice literally their total sanity for five years straight to pay off student loans only to be broken humans at the end of their life.

I want more for you than that. If it takes you an extra year more than you want, but you’re being responsible and you have a plan that is low stress and sustainable, isn’t that exactly what you’re looking for? Not some magic bullet to crush these babies overnight (I mean, though I would totally order that on amazon if it existed). In the end, let’s just confidently pay off these loans so we can be financially savvy in all our years ahead.

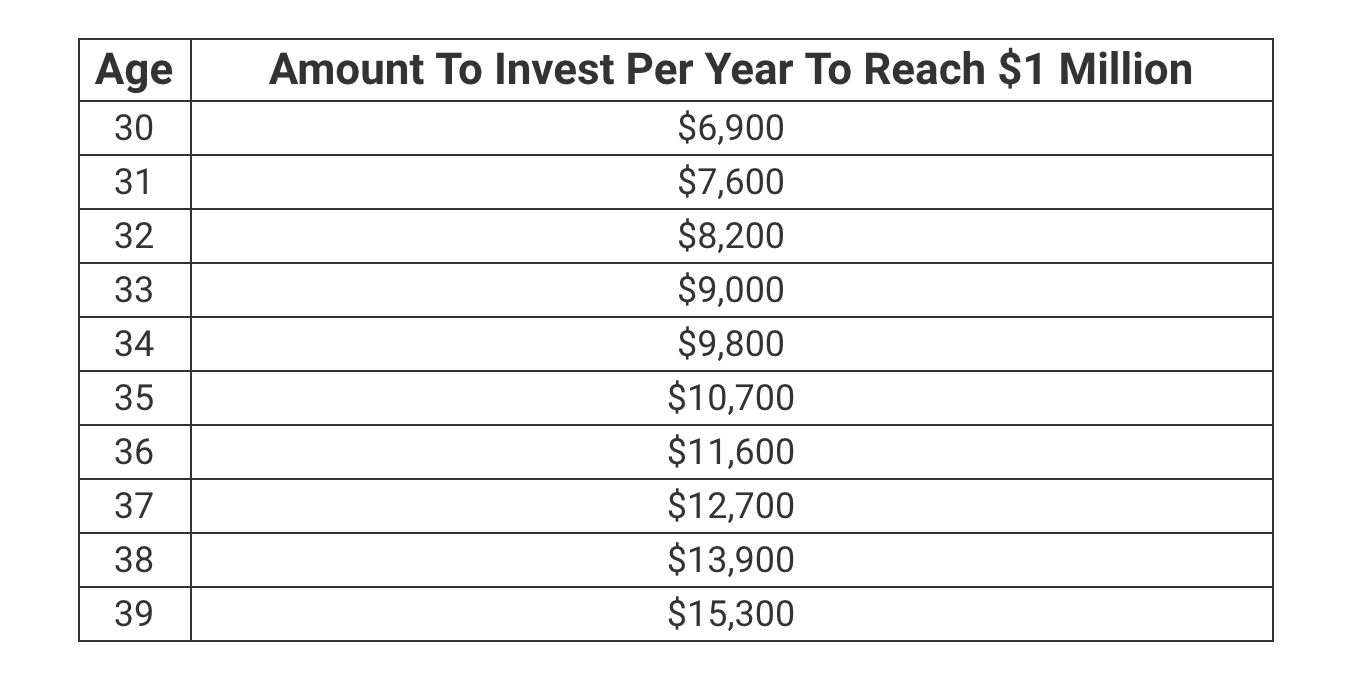

A good place to start with retirement if you’re 30 years old or less is 300-500/mo. 500 dollars a month will help you reach 1 million in retirement dollars if you maintain it until you’re 65 years old. If you’re older than 30, check this retirement plan chart out to see where your numbers fall. The biggest thing though, is to save every month, something and increase it as your income increases.

Here is the article where that photo was taken from that has more information about retirement savings in your thirties by The College Investor.

to sum it all up…

At the end of the day, the biggest take-aways for successfully paying off your student loans can be boiled down to three areas: be mindful of your spending and plan ahead, change your perspective on money and figure out how to create more of it, and track all the things to keep you motivated. If you haven’t yet, make sure you also check out our free facebook group the debt free support network.

AUTHOR: Dr. Lauren Baker, DPT, PT, ATC, MTC is a Physical Therapist, Certified Athletic Trainer, Online Fit Coach, Military Wife, & Circus Addict who is obsessed with sharing all her adventures & knowledge so that you know that literally ANYTHING is possible with a little bit of Google & a WHOLE lot of courage. ps let's hang on instagram.

Don’t Miss Out On Free Stuff!

Have you checked out the free library yet?

I’m kind of obsessed with creating pdfs and free guides so make sure you’ve checked it out before you go. I’m always adding new stuff, so if it’s been awhile make sure you log back in!