Graduating Physical Therapy school with over 150,000 dollars in student loan debt is financial suicide if you choose to avoid it instead of doing something about it.

Let’s get real, you need a plan. Learn how I’m paying off six-figure student loan debt with a Physical Therapist’s salary and all the mistakes I’ve made along the way.

This post contains affiliate links, please see my disclaimer for more information.

I graduated from Physical Therapy School with $151,000 of student loan debt.

In 2013, the exact number that I had in student loan debt was $151,613.50. Broken down this was $94,000 in tuition over 2.5 years, the interest that accrued during school, and $57,000 in living expenses ($22,800/year in southern California).

I am honestly obsessed with the education I got from the University of St. Augustine for Health Sciences (San Marcos, CA campus) and would recommend them whole-heartedly.

That being said, Physical Therapy tuition (and all university tuition in general) is out of control and does not produce a return on your investment within the first ten years of your career in most cases. If looking to become a Physical Therapist, please consider the financial aspect in advance (loans, average salary, the area you want to live, etc).

How my student loan debt was divided up

The $151,000 was broken up into eight loans with varying sizes and styles. They included both federal and private, fixed and variable interest rates, and small to gigantic amounts.

Grad Plus Loan

41,670 initial loan amount (47,681 with interest in June 2013)

A Fixed Interest Rate of 7.9% (this one was drowning me and eating me alive at the same time)

10-year term or 25-year term options (I went 25 yr)

Monthly payment 364.84

Accrued interest while I was in school

Unsubsidized Loans

3 loans = 20,500, 12,000, 12,000 initial amount total of 44,000

a fixed interest rate of 6.8%

10 yr and 25 yr

Monthly payment 324.61

accrued interest while I was in school (total loans 46,769 as of June 2013)

Subsidized Loans

8,500 x2 loans = total amount of 17,000

A Fixed interest rate of 6.8%

10yr and 25yr terms

Monthly payment 117.99

Did not accrue interest while I was in school

Sallie Mae Private Loan

35,000 initial amount (35,486.23 with interest as of June 2013)

A varied interest rate of 2.5%

Required that I pay 25/month while in school

Monthly payment $338.58

A cosigned loan with my dad

To show the power of compound interest, my loans went from 146,000 to 151,000 dollars simply due to interest from June 2013 (when the above calculations were taken) to February 2014 when I started paying back my loans after the six month grace period ended when I graduated in August of 213.

My average interest rate on $151,000 was 7.2% because the 7.9% grad plus loan was murdering my soul and my financial future.

To find your average interest rate, take all your interest rates, add them up, and then divide them by the number of loans you have (it is not the most accurate number to use during calculations but can help you conceptualize what you’re dealing with).

I realized that if I didn’t decrease my interest rate, I was never going to be able to save for retirement, create financial stability, and I would always be running after this debt and never feel like I could catch up.

Compounding interest is a GEM and one of the most amazing things ever if you’re on the RIGHT side of it. The absolute truth is, my compounding interest on $151,000 at (an average of) 7.2% was total financial suicide.

My first plan to pay off student loans started 2-4 months before graduation

The most important thing when you are looking at paying off six-figure student loans is to create a plan that fits your life. When I was in my last semester of Physical Therapy school, I started trying to figure out what my life would look like after graduation.

My mother had lovingly forced me to apply for all my own loans and secure financing for graduate school before signing my acceptance letter in 2011, so I knew I was on the hook for a lot of dollars: $151,613 and one-half dollars to be exact.

I knew I wanted to move to North Carolina to be with my Marine Corps boyfriend who was stationed there, so I had a place to start.

Initially, my plan was to pay off my loans in 15 years, because I didn’t whole-heartedly trust that the government would uphold their end of the bargain with public loan forgiveness and if I didn’t have the money to pay for my loans now, how was I going to pay for the upwards of $25,000-50,000 tax bill that comes the year your student loans are forgiven with income-based repayment plans. If this is shocking to you, learn more about your potential tax bill here.

my budget in 2013-2014 with student loans and 60k salary

Student loans: $1146.02

Car insurance: $60

Health insurance: $160

Housing/utilities: $980 (started March 2014, was $300/mo plus utilities from November to February)

Retirement: $250 (started in March 2014)

Groceries: $400

Gas: $200

Gym membership: $50/mo (I still can’t believe I paid this when I now pay $8/mo for better results)

Leftover: $16.02/mo (makeup, clothes, eating out, happy hour, decor for the house which is basically nothing).

I figured out that I needed a minimum of $60,000 a year to live. As a Physical Therapist, this was do-able. This would leave me $3,230/mo after tax to pay my bills, twice a year I received an extra $1615.38 (total 3230) due to pay cycles and one would go toward Christmas season (travel home, presents) and one would go toward summer “fun” activities (concerts, dinner out, etc).

I would put the two extra paychecks that I got twice a year into cash and use it for spontaneous things people asked me to do, when it was gone I had to say no to anything else.

Top Six things I learned during this season

Create a list and then figure out how much you need to make in order to make your list (budget) work

Consider switching from a 10-year loan term to a 25-year loan term and lower your monthly payment so you can put more toward retirement

Try refinancing and make your money hold more value (ie less to interest and more to principle)

Look for a roommate (or consider moving home for a year or two) so housing expenses are lower

Switch from a gym membership to working out at home online

Become your own expert by reading blogs on how to negotiate for a higher salary and how to not low ball yourself when interviewing for jobs

I accepted a job prior to graduating in 2013 at an outpatient clinic in Jacksonville, NC for $60,000. I graduated in August 2013 from Physical Therapy school and moved home with my parents until October 2013. I took the NPTE (our national licensing exam) two weeks after my boyfriend came home from his deployment to Afghanistan and then moved to NC the day after the exam (when life gets stressful I try to put myself back in 2013 Lauren’s shoes, that girl was an emotional badass). I received the results that I passed (thank goodness) and started working in November 2013. My student loans required payment between February and April of 2014.

Mistakes I made paying off student loan debt my first year out of Physical Therapy School (2013-2014)

During this time in my life, I didn’t really understand the difference between living on the bare minimum I could possibly live on to survive and negotiating for a salary that would allow me to live reasonably.

I had a few factors against me:

the job market in NC was tough and I wanted to live within 45 minutes of my boyfriend after being long distance

I didn’t ask for over my minimum price (now I ask for at least 5-10k over what my minimum is, ideally settling ABOVE the minimum I need to live on)

I lived on rice and beans, which wasn’t healthy.

It was really important to me to “do it on my own,” my first year out of PT school. I didn’t want to move in with my boyfriend, because in all honesty, we just weren’t ready.

I tried to look for roommates in Jacksonville, NC after I moved out of my first place but one search on craigslist, and I was actually terrified of the people living in that city. If you don’t believe create your own horror movie by searching on craigslist in yourself.

One thing I did well: I saved $5,000 for a cash bubble during my six month grace period before my student loans were due. When I first moved to Jacksonville, NC I rented a room for $300/mo which decreased my housing expenses and allowed me to save from October to February when the drama in the apartment became intolerable and not worth the savings so I moved out.

Eventually, I asked for a raise at my job after a year, and I was faced with a hard truth about the Physical Therapy outpatient world: often, the only way to increase your income is to quit and find another job that pays more. Raises are barely to the level of inflation at 2-3% if you get a raise at all.

I remember telling my boss, “if my car died right now, I would have to move home because I cannot afford a car payment at this salary.” By the middle of 2015, I realized that something needed to change so I started looking for different jobs.

Tools I used to help me pay off student loans with less stress

Google everything on student loans: I would stay up late at night, way past my bedtime, and google “six-figure student loan success stories,” for hours. I wanted to know how someone did it without moving home with their parents or living with their husbands and using one income to pay loans while they lived off the other.

Track every penny: I realized somewhere in my heart, that if I tracked every penny I could make those pennies MEAN SOMETHING. If I could pay off $151,000, I could probably also SAVE $151,000. I just needed to SEE daily that I was making progress.

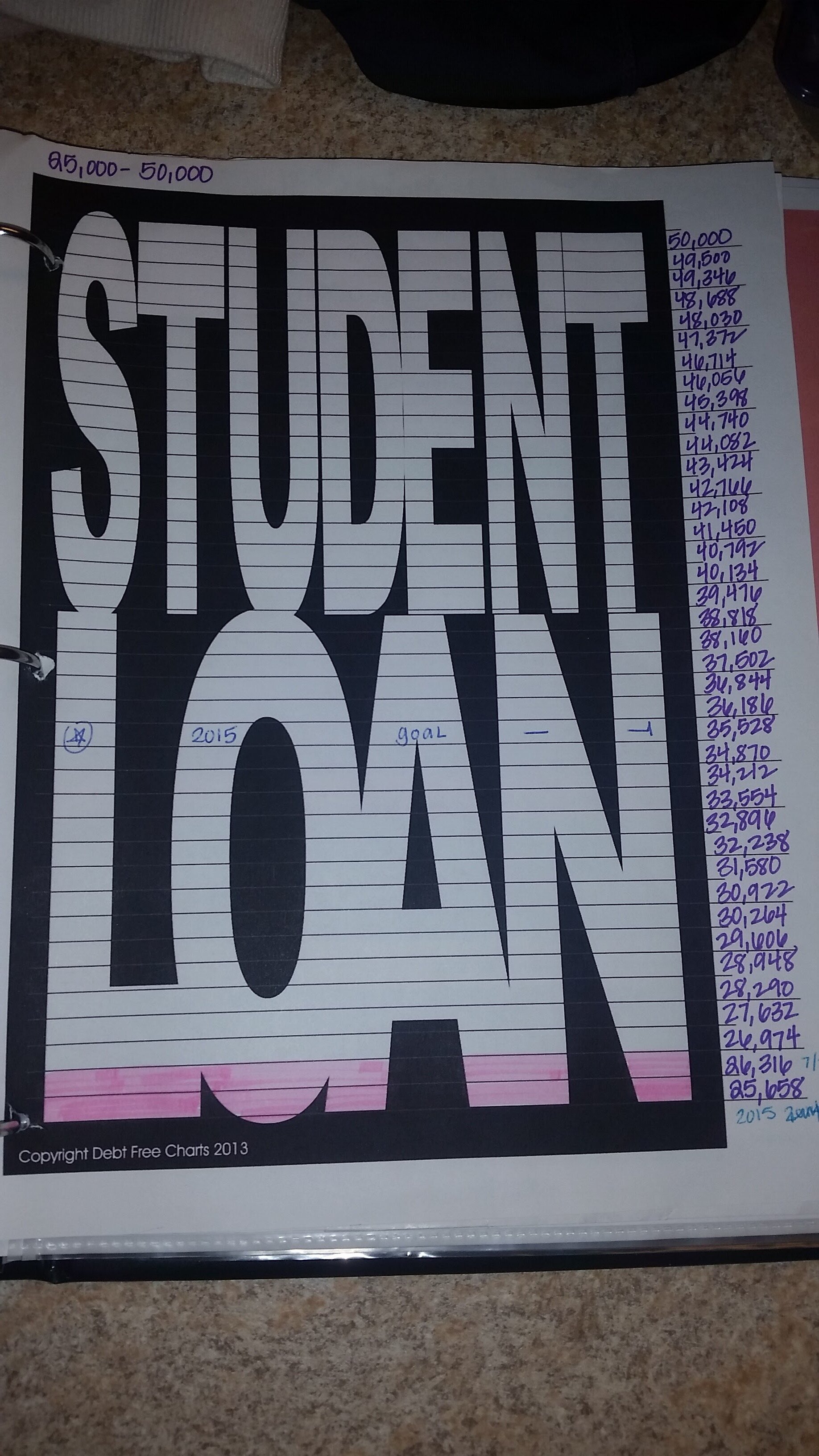

Use trackers that require coloring in your wins: Trackers I used include the student loan tracker sheet and the free your soul tracker.

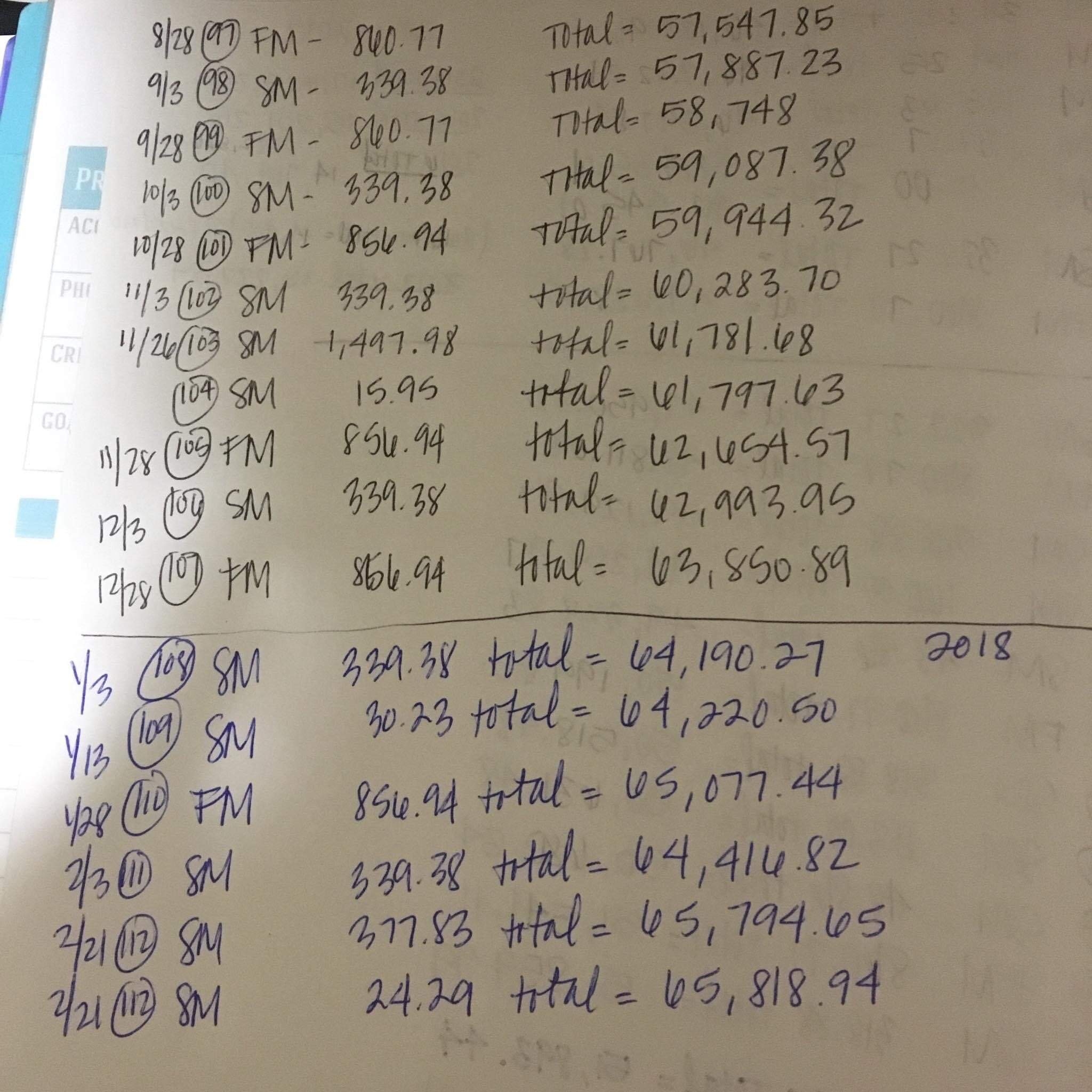

Post trackers where you can SEE them DAILY: I put both my tracker and a blank sheet of white paper in the kitchen where I could see it daily. On the blank paper I would calculate every penny I put toward my student loan debt and total it up so I could see how much I was “saving.”

Make your money work for you: I used websites and credit cards to get cash back and put this extra money toward loans. Every single dime held meaning and it all added up.

Pay your credit cards off every month: I had enough debt to worry about, thank you very much.

Use the USAA “custom loan calculator” app to determine how much you’re paying in interest, what it’d look like if you paid xxx extra per month, and what it would look like if you refinanced for a lower interest rate. PS you don’t have to be a member, just x out of the log in part after you download the free app.

Now I keep my trackers in a binder and even seven years later I still update it every single month.

Now those pennies are WELL OVER $100,000.00. Sure, I’ve paid that amount to other people but there is nothing in this world that says I can’t also eventually pay that kind of money to myself.

Why I chose student loan refinancing to pay off six-figure student loans

There are a million different ways to get out of six-figure student loan debt. You can use the snowball method, the avalanche method, income-based repayment plans, public student loan forgiveness (if you qualify), income-based repayment combined with investing what you would’ve paid toward your student loans if you believe you can make more in the market than your interest rate, etc.

What is right for you? I honestly have no idea. But here is how I chose what is right for me.

I do not trust that the government will be able to withstand the burden of student loan debt (over a trillion dollars at 6-8% interest rates); therefore, I do not trust all these programs will exist the same way they are talking about them right now and I need a plan that only changes if I change it.

I cannot afford to pay taxes on $100,000 of forgiven debt that will count as income the year it is forgiven (income based repayment plans). 25% federal income tax on $100,000 is a $25,000 tax bill THAT year (typically 25 years after qualified payments). Check out the two examples below.

If I picked the “pay as you earn” loan option that was available in 2013:

“pay as you earn” loan option on $130,000 would result in $353/mo to start with and a max monthly payment of $1395/mo (as your income increases so do your monthly payments).

After 300 monthly payments (25 years), you would have $103,160.00 forgiven and paid $227,326.00.

Let’s say you started in 2013: 25 years later would be 2038.

In 2038, you would owe the IRS $25,790.00 on the $103,160.00 that was forgiven.

Where exactly, would you get the 25k? Do you have 25k just lying around right now?

If I would’ve picked the income-based repayment plan:

The “income-based repayment” loan option on $130,000 you would result in $353/mo to start with and a max monthly payment of $1035/mo (as your income increases so do your monthly payments).

After 240 monthly payments (20 years), you would have $152,689.00 forgiven and paid $154,689.

Let’s say you started in 2013: 20 years later would be 2033.

In 2033, you would owe the IRS $38,172.00 on the $152,689 that was forgiven.

Where exactly, would you get 38k? I mean can you imagine getting a bill from the IRS this year asking for $38,000?

To combat the tax bill shock, Insurance companies will tell you to take out a life insurance policy that basically allows you to borrow from it to pay this off. For some people this might be an ok solution; to me, it sounds like robbing Peter to pay Paul.

I can invest my money on my own thank you very much (ps vanguard probably has a lower fee than insurance companies do, so no thanks x32).

Other things I considered:

The Public Student Loan Forgiveness Program is sadly a cluster, which sucks because THOSE people deserve it x100000. But again, this is me being distrustful of other people holding that much power over my financial future. Plus, I just don’t like having limitations on where I can work.

I would rather figure out how to make more money than to feel like someone else had control over my financial future.

While investing the money you would have put toward student loans and then doing income-based repayment could be a smart financial move in hindsight, it held too much risk for me. I just didn’t want the interest on $151,000 to loom over my head and God-forbid something happens and now I owe $300,000.

So, in the end, I chose a mostly safe option of refinancing all of my loans (federal and private) over a period of seven years and three refinances to private bank companies for fixed lower interest rates.

After refinancing, I lost any federal protections including potential federal loan forgiveness if that ever happens, but what I gained, will be even more beneficial for me so I’m at peace with it. If the federal government wants to forgive private and federal student loans (doubtful) sure, count me in, but let’s be real here folks, it’s probably not going to happen, so don’t ruin your financial future over it.

What my first student loan refinance looked like with Firstmark Services and Citizens Bank

I had to work for a solid year before I was able to refinance for the first time in the fall of 2014. Back then, it was basically the Stone Age of refinancing and I had to FAX, yes FAX, 50 pages of documents to Citizen’s Bank. It was pretty obnoxious and took a lot longer than it does now (you can upload all documents online for most refinance companies).

I’m honestly not sure what my credit score was, but I didn’t have any credit card debt. I believe it was in the 700s (usually anything over 720 is pretty good).

I ended up co-signing my first refinance with my dad to get a better interest rate. I ended up refinancing only my federal student loans, I kept my variable interest rate Sallie Mae student loan with the plan of refinancing it in the future if it increased more than 3.5%.

It broke down like this:

Federal Grad Plus Loan (7.9%) + Unsubsidized (6.8%) = 107,142 dollars

Refinanced with Citizen’s Bank (think of them as the middle man paperwork people) who then “sold/gave” the loan to their servicer Firstmark

A new loan with Firstmark Services (who I actually paid monthly): 107,142 dollars 4.9% interest rate

Released my dad as a co-signer after 12 months of on-time payments (really easy, just signed and uploaded the paper)

New monthly payment: $846 dollars at 15-year term

Sallie Mae Private Loan (2.5% variable) = 33,097.54 dollars

Kept this loan due to the lower interest rate (2.75%) $350 (increased from initial 2.5% interest rate payment of 338/mo)

Total Monthly Payment: 1196.32 dollars

Increase in monthly payment: $50.30

Salary in 2014-2015 was 63,000. Switched job in March 2015 to try travel therapy which increased my monthly unallocated amount to 400-500/mo making this easier to swing.

Top Three Changes during my first student loan refinance and this season of life

I still had my cash bubble and I had increased confidence: An increase of $50/mo was a lot for me at that time, but after a year of budgeting and no big emergencies which allowed my cash bubble to stay at $5,000, I felt comfortable extending myself a little further.

I transitioned to travel Physical Therapy for a six-month contract in Alaska: which allowed me to take home more money with fewer taxes.

I started a side hustle: I became a health and fitness coach during 2015, partnering with Beachbody, so while I didn’t (don’t) make a full-time income, I was/am still able to cover my fitness membership (bringing it from $50/mo to $8/mo), my supplements (I drink Shakeology and use pre/post workouts), and clothing/additional health expenses.

For me, adding an additional stream of income gave me a hobby outside of work that helped me feel less burnt out, brought me an additional income that covered my fitness costs, and literally gave me hope and stories from others who had used alternative (out of the box) methods to pay down debt.

After I came back from Alaska in the fall of 2015, I was able to secure a school-based physical therapy position that made $45/hour; which was 60,750 in nine months of work. I was also able to see some kids over the summer, further increasing my income.

Mistakes I made paying off student loans and changes that occurred in my debt story (2014-2016)

From 2014 to 2015, before I was introduced to personal development (a habit encouraged through my fitness company partnership with Beachbody) I focused solely on paying off debt. I thought this was what I should do and how I would pay it off faster.

In hindsight, there’s this principle that states, “what you focus on you attract more of.”

Focusing on debt inevitably created more debt: In 2015, after getting back from Alaska (where I rented a car and left mine in storage) my Rav 4 started having transmission problems. Turns out, there was a transmission/computer glitch where the transmission would get “choked out” by the computer. I had to buy a new car and I drained my $5,000 cash bubble since ya know this was an emergency (terrifying to do though) and bought a car.

I now had a $304 monthly car payment which changed a lot of things

I had to ask for help and I wasn’t able to do it “on my own anymore,” which was a blessing and a significant frustration: At the time I was living with my friend Rachel and my boyfriend who covered my part of the rent (after I literally balled my eyes out to my boyfriend saying that I would have to move home because I couldn’t afford the car and rent while at the time I was only working 24 hours a week because of low caseload numbers).

My boyfriend and I finally decided to move in together: At this moment, I became one of the stories I kind of despised -- because I stop paying rent for the rest of this story (& my life). So, sorry all you single ladies and men out there trying to do it on your own. Gosh, it’s tough, but I see you, keep working it.

Refinancing student loans a second time with Laurel Road and Mohela

In my second refinance in 2018, my variable private loan had increased from 2.5% to 3.5% and was increasing quarterly. I knew I needed to act on it fast to decrease the amount of potential damage. By this point, I had never missed a payment and my credit score was in the 800s (still no credit card debt).

I refinanced my Firstmark Services private loan (the one I received after refinancing through Citizens Bank) of $92,847.19 at a 4.99% fixed interest rate + my Sallie Mae private student loan of $21,458.01 at a 3.5% variable interest rate (and climbing) for a total of $114,305.20 at a 4.24% fixed interest rate and 7-year loan term with Laurel Road who then “sold/gave” my loan to Mohela (who I paid my monthly payment to).

I ended up increasing my payments/month from 1196.32 to 1548.56/mo. I was able to do this because I was making at this point in my career in the school-based setting upwards of 75k/year and not paying rent (living with my boyfriend).

I know folks, if you’re doing it on your own, it’s brutal, I get it, it’s ok if your numbers are smaller or longer terms than mine. What’s important is that you are getting lower interest rates and you have a freaking plan.

This new loan was an increase of $352.24 more per month than my previous loan (again, you do not have to increase your monthly payments, in fact, a lot of people decrease their monthly payments after refinancing, but if you can, you will pay it off faster and get a better rate). This also was $50.30 + $358.63 = $408.93 more per month than I was paying in 2014 (four years earlier).

Refinancing student loan debt for a third time with SOFI and Mohela

By this time, I might have felt like a crazy person and got slightly obsessed with getting the lowest interest rate of anyone on the face of the planet. I had just refinanced in 2018, but wasn’t really sure I wanted to renew my APTA membership to keep my 0.25% discount + 0.25% discount with autopay at Laurel Road. Without my APTA membership, my interest rate would’ve gone up to 4.5%.

This time, I decided to try Sofi. In 2018 they didn’t have the best rate when I added my APTA discount in, but I decided why not, I kind of dug their company. This time, I was able to secure a 5-year loan at a 3.97% interest rate for my remaining $89,508.10 (again without a cosigner).

I ended up increasing my monthly payments to $1657.82/mo (an increase of $109). The reason I increased it was because I was making good money over $75,000, not paying rent because I was living with my active duty boyfriend, and I wanted a sub-4% loan (interest rate game).

Mistakes I made paying off student loans and my vision for the future of my student loans (2018-2020)

During 2018-2020, I ended up being kind of obsessed with interest rates and checked my rates a little too often. Whenever an article would pop up about student loan interest rates I would check them, often requiring a hard credit pull.

Checking my rates so often (3-4x in 12 months) decreased my credit score from the mid 800s to high 700s

My husband (we got married yay!) and I have been talking about changing up our goals and refinancing for the fourth time to decrease my payments from 1657/mo

We would hit our 8-year goal of being financially independent by his military retirement date

BUT If we re-financed for a fourth time to decrease my monthly paying it would mean I paid my loans off by August 2025 instead of ten years, which would be February 2024, and I’m not 100% sure how I feel about it, so we’re post-poning this until at least 12/2020.

Prompting our potential fourth student loan refinance is the fact that we moved to an area with a lower income than Washington state ($75,000) and I am now making only $40,000. My non-negotiables continue to include $500 to retirement, $304 car payment, and $1657 student loans (which is basically my entire salary right now).

It’s literally a journey, but in all honesty, as long as you have a plan in place and you’re not avoiding paying off your six-figure student loans, that is what is key. Your budget, income, strategy, and mindset will change during your student loan journey. The important part is that you do not avoid it and that you have a SOLID plan in place, whatever that plan may be.

It’s been a wild seven years since I graduated from physical therapy school with over 151,000 dollars in student loan debt. I’ve gone from counting every single penny to making peace with my student loans and from stressing and obsessing to teaching others how I did it.

I hope my experience broke down exactly how I was able to pay down my debt (68k to go as of August 2020) and am on track to pay it off in ten years (or maybe more if that turns out to be a better life choice for us).

If you’re looking for more information about student loans check out the articles below.

AUTHOR: Dr. Lauren Baker, DPT, PT, ATC, MTC is a Physical Therapist, Certified Athletic Trainer, Online Fit Coach, Military Wife, & Circus Addict who is obsessed with sharing all her adventures & knowledge so that you know that literally ANYTHING is possible with a little bit of Google & a WHOLE lot of courage. ps let's hang on instagram.

Don’t Miss Out On Free Stuff!

Have you checked out the free library yet?

I’m kind of obsessed with creating pdfs and free guides so make sure you’ve checked it out before you go. I’m always adding new stuff, so if it’s been awhile make sure you log back in!